INVEST IN YOUR FUTURE

The accredited Global Master of Science in Finance (Global MS in Finance) program from the Richard DeVos Graduate School of Management positions you for opportunities in the world of finance and helps you grow as a leader shaping the future. You will learn about the role of financial institutions, the mechanics of financial intermediation, and the growth of digital channels from renowned faculty as well as experts. As a participant in the Global MS in Finance program, you will utilize advanced methods to: analyse financial data; propose, structure and execute financial and operational strategies; and benchmark results and modify financial plans accordingly. You will develop the acumen to play an important role in the ever-changing and expanding world of global finance.

The Global MS in Finance program is engineered around the most advanced financial theories, quantitative models, and industry practices. It will prepare you to meet requirements across a broad range of modern career opportunities in sought-after established financial institutions, asset managers, consulting firms, investment and corporate banks, brokerage firms, financial data providers, ratings firms, hedge funds, venture capitalists, insurance companies, fintech, and more — from Fortune 500 companies to leading-edge boutiques as well as the emerging disruptors in digital finance.

GET STARTED

Please register below to receive program brochure and connect with a program advisor.

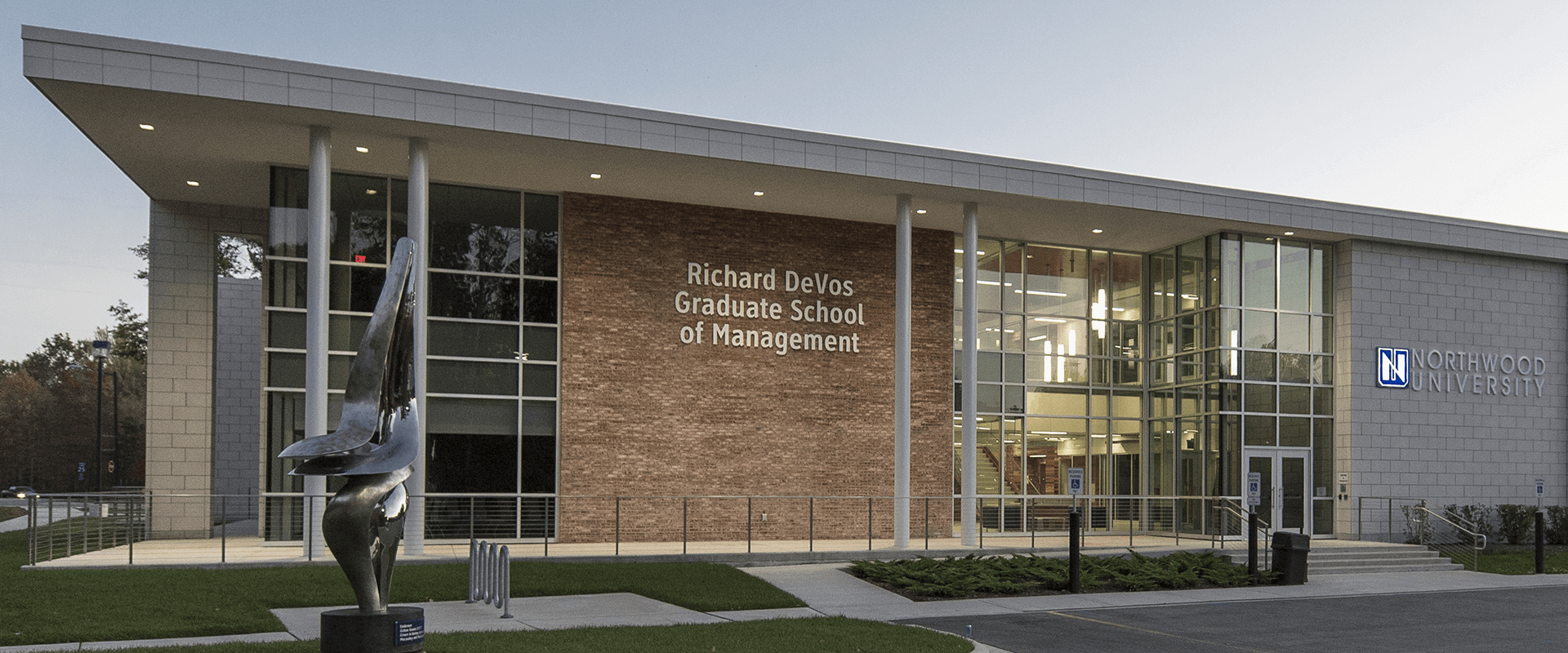

THE DEVOS DIFFERENCE

Business is a vocation at Northwood’s DeVos Graduate School, built upon a foundation of ethics, responsibility and the benefits of free-enterprise. For over 25 years, the Richard DeVos Graduate School of Management at Northwood University has prepared students for success as global business leaders. DeVos students develop critical thinking skills through problem-solving and collaboration rather than lectures and memorization. Our faculty have real industry experience that they use to guide class discussions and real world case studies.

- Industry-leading faculty facilitate learning through interactive discussions, research, and presentations.

- Learn finance through the practical application of concepts which develops broad-based decision-making capabilities that are critical to your career success and are immediately applicable to the workplace.

- Integrated curriculum including a capstone course and several courses focused on building a rigorous background in the technical fundamentals of financial analysis and developing critical thinking skills.

- Participants who are seeking the CFA (Chartered Financial Analyst) professional designation, will benefit from the Global MSF program curriculum with concepts that may assist with preparing for the exam.

CURRICULUM

The Global MS in Finance program at the DeVos Graduate School will prepare you to build a career with a solid foundation in finance. A rigorous, hands-on curriculum offers you the chance to build a deep reservoir of finance knowledge and immediately put that knowledge to work in the world. You will develop a deep understanding of how markets work and a comprehensive range of quantitative finance skills, along with applied, problem-solving expertise.

The Global MS in Finance program curriculum covers a breadth of areas so you can pursue your calling in diverse settings such as corporate finance, banking, financial services, fintech, insurtech, and many more. You will gain a skill set that employers today find invaluable, including:

- Critical thinking and problem solving skills to help you address the most pressing challenges.

- Leadership skills and communication techniques that set you up for success.

- Exploring advanced methods for analyzing financial data.

- Learning to propose, structure, and execute financial and/or operational strategies.

This course explores economic theory and practice at the level of individuals and businesses. It explores various economic theories and compares them against empirical evidence. Finally, the course focuses on how the insights gathered can be applied to inform successful business practice in the real world.

This course introduces students to the essential elements of accounting principles and their usage in financial reporting. Students will learn how to read, assess and interpret financial statements. They will also learn where and how to access publicly available financial information. The course will also demonstrate how to use core accounting information for various financial benchmarking and modeling outcomes.

This course introduces students to the foundational knowledge that is essential for any person who is involved in the field of corporate finance. Core concepts that are explored include, but are not limited to, understanding time value of money principles, designing cash flow projections, calculating and applying weighted average cost of capital, assessing capital investment expenditures, and balance sheet management.

This course surveys the contemporary field of investing. Students will be introduced to significant theories regarding the operations and behavior of capital markets. The course will also introduce students to the variety of investment vehicles available in the marketplace, including equities, fixed-income securities, derivatives, and non-traditional investments. Finally, the course will cover the beginning elements of portfolio construction.

This course introduces students to the methodologies of analyzing and interpreting GAAP financial statements from a finance perspective. Students will learn how to generate financial projections from financial statement data in order to assess future business performance. By the end of the course, students will be capable of accessing core information, projecting future cash flows, and will be introduced to entity valuation concepts.

This course introduces students to the methodologies used to value business enterprises. Students will learn various market-accepted valuation models used to estimate entity market value. The course will also investigate the dynamic nature of the mergers and acquisitions marketplace, with an emphasis on understanding common negotiating points and potential pitfalls that often occur in private sector mergers and acquisitions.

This course considers the field of risk management. It will review the current state of global and domestic insurance markets. Students will learn techniques, including the use of derivatives, which will enable private sector companies and investors to manage the levels of volatility outcomes in various financial scenarios.

This course is an in-depth look at how finance is an integral element in the strategies of business entities incorporating diverse entity functions such as finance operations and sales. Students will investigate the interrelationships between these functions in creating a well-designed strategic business plan. They will also be introduced to appropriate ways to benchmark and adjust strategies in the face of changing market environments. The course will also address how macro-level economic, political and technological variables can impact an entity’s performance.

This course teaches students techniques and methodologies that are appropriate in constructing investment portfolios. Students will identify outcome goals in light of risk and reward tolerances and then construct portfolios that align with the initial objectives. They will also learn how to appropriately benchmark and adjust the portfolio composition in light of changing events and trends.

This course develops the student’s ability to anticipate, evaluate, and respond to shareholder expectations using strategy and measurement concepts. This requires the student to develop the ability to simultaneously evaluate and manage the organization’s internal and external environment. Skills to satisfy shareholders include: articulating vision, choosing boundaries and lines-of-business, and identifying and managing capabilities/resources across multiple lines-of-business. The integration of the concepts of free cash flow projection and company valuation explores how strategy drives these measures, which in turn drive value back to the shareholder.

DISTINGUISHED FACULTY

Dr. Oluremi Abayomi

Ph.D – Central Michigan University

MA – Central Michigan University

BS – University of Lagos, Nigeria

Dr. Abdulaziz Ahmed

Ph.D. – State University of New York

MS – Jordan University of Science & Technology, Jordan

BS – Jordan University of Science & Technology, Jordan

Dr. Peter Bush

DBA – Lawrence Technological University

MBA/MSCIS – University of Detroit Mercy

BBA – University of Michigan-Flint

Dr. Ed DeJeagher

DM – Case Western Reserve

MBA – University of Notre Dame

MA – Marquette University

BBA – St. Ambrose University

Dr. Lisa Fairbairn

Ph.D. – Michigan State University

MS – Michigan State University

BS – Michigan State University

Dr. David Lyman

Ph.D. – University of Nebraska

MA – University of Nebraska

BA – Dakota Wesleyan

Dr. Don Majors

DBA – University of Phoenix

MA – Upper Iowa University

BBA – Upper Iowa University

Dr. Matthew O’Connor

Ph.D. – Union Institute & University

MBA – Bloomsburg University

BA – Westfield State University

Dr. Joe Perez

Ed.D. – Nova Southeastern University

MBA – Nova Southeastern University

BA – University of South Florida

Dr. Tara Peters

Ph.D. – Union Institute & University

MBA – Dallas Baptist University

BBA – Texas Wesleyan University

Dr. L. Todd Thomas

Ph.D. – Indiana University

MS – Indiana University

MA – Auburn University

BS – Morehead State University

TIMELINES

The Global MS in Finance program degree is completed in 12 months. Two flexible formats provide you with the choice to either begin the program online and then transition to being a full-time student on-campus, or complete the entire program as a full-time student on-campus.

- Format 1: You will experience the entire 12 months of the program on-campus at Northwood in the US.

- Format 2: You will complete 2 months of the program online, and then transition to 10 months on-campus at Northwood in the US.

This flexible structure allows you to leverage your learning in the format that better suits your preferences. Whichever format you choose, you will receive all the required paperwork and documentation to enable you to get your study visa. You will apply for the F-1 visa at the suggested US Embassy or Consulate (as the case may be) and receive your visa approval to travel to the US and join Northwood on campus.

OPTIONAL PRACTICAL TRAINING – US OPT

- You will be eligible to participate in the US OPT – Optional Practical Training program for F-1 students upon the completion of your MSF degree, allowing you to stay in the US while you start your career in finance.

- Optional Practical Training (OPT) is temporary employment in the US that is directly related to an F-1 student’s major area of study. Eligible students can apply to receive up to 12 months of OPT employment authorization before completing their academic studies (pre-completion) and/or after completing their academic studies (post-completion). Please click here to know more about OPT.

ADMISSION

APPLICATION PROCESS

The Global MS in Finance program follows a rolling admissions (first-come, first-served) process and participant applications are evaluated as soon as they are received.

STEP 1: COMPLETE APPLICATION

The first step is to fill out the online application and attach all required materials as outlined in the requirements above.

STEP 2: APPLICATION REVIEW

The admissions team will assess your application and advise you of the next steps including the need for an interview (if required).

STEP 3: ADMISSION

The admissions committee will notify you with a decision once all the application requirements are completed.

For admissions support, we offer online office hours, an admissions checklist, and email and phone support to answer your questions.

APPLICATION REQUIREMENTS

Applicants for direct admission to the degree program are required to have:

- A bachelor’s degree or equivalent: You must have earned a bachelor’s degree from an accredited institution in the United States or an equivalent degree from an accredited institution in a foreign country.

- Applicants who have not undertaken recognised studies taught in English (e.g. an undergraduate degree) are required to demonstrate a proficiency in English as per the guidelines.

Degree applicants are required to submit an application for admission with these supporting materials:

![]() Resume, including details of supervisory or professional experience.

Resume, including details of supervisory or professional experience.

![]() Details of academic qualifications.

Details of academic qualifications.

![]() IELTS or equivalent English Language results dated within the last 2 years.

IELTS or equivalent English Language results dated within the last 2 years.

Shortlisted candidates might be required to go through an interview before they are accepted into the program. This interview may be conducted in person or over the telephone.

If you have questions about the application process or eligibility, please send us an email.

KEY DATES

- Considering the limited seats in the program and first-come, first-served admission process, it is always more beneficial for candidates to apply as soon as possible.

- Application fee is refunded only in the case an applicant is not offered admission to the program.

TUITION & SCHOLARSHIPS

TUITION

*

Participants may qualify for scholarships upto USD 6000.

*The fees does not include transport expenses, any associated visa fees etc. and accommodation. It also does not cover any other expenses that are not expressly mentioned above.

ADMINISTRATION FEES

| Graduation | $80 |

| Transcript (special delivery charges may apply) | $5 |

| Material fee (per course, MS Finance only) | $95 |

The Global MS in Finance program cost is exclusive of instructional materials required for the completion of the program and other miscellaneous costs. Additional books are not included in the Global MS in Finance material fees.

Healthcare plan is mandatory and is available for approximately USD $1,416* for the on-campus year of the program. (*Subject to change per academic year)

FINANCIAL AID

Many participants who attend Northwood receive financial aid. Available aid options vary from student to student based on circumstances.

FEDERAL AID

If you are a US citizen or permanent resident, you might qualify for federal aid. To learn more please see our guide to FAFSA.

SCHOLARSHIPS

The aim of the scholarship programme is to provide outstanding candidates with an opportunity to study irrespective of their financial circumstances. Northwood offers significant scholarship funding to the most talented applicants for the Global MSF program.

All applicants for the Global MSF program are eligible to apply for the following scholarships:

- Merit-based Scholarships

- Need-based Scholarships

- Women in Business Scholarships

- Emerging Markets Champion Scholarships

- High Potential Employees Scholarships

In addition, those who apply in round 1 are automatically considered for the Early Application Commitment Scholarship. Please add your statement for scholarship consideration as part of the online application.

CAREER OPPORTUNITIES

The finance industry is broad, interesting, and challenging. If you like working with numbers and figuring out the story behind them, this might be a great career for you. Finance can open many doors to various career opportunities around the world, from financial management or insurance, to commercial banking and investment banking. Working in finance can be very rewarding – both financially and intellectually, with earning potential ranging massively depending on your experience, position, and the industry you work in.

Here are some relevant data points that give you a glimpse of a career in finance:

75% of Master of Finance programs reported increase in applications, with an increase of 115% in Master of Finance applications in 2020 compared to the previous year.

The demand of financial analysts will grow by 11% through 2026, faster than the average for all occupations.

Masters of Finance graduates in the USA are more likely to have higher employment opportunities with for-profit public, Fortune Global 100, and 500 companies compared to the previous year.

The finance industry offers some of the most rewarding careers. Employers include commercial banks, brokerage firms, hedge funds, private equity firms, insurance companies, asset managers, investment banks, consulting companies, fintech companies, and many more.

*Source: Indeed.com, GMAC Application Trends Report 2020, GMAC Corporate Recruiter Survey 2019

PROGRAM EXPERIENCE

The DeVos Global MS in Finance program provides working professionals from various backgrounds a collaborative yet focused program where professors challenge students with practical readings, applicable case studies, and real-world assignments to promote a deeper understanding of financial concepts. In the program, I’ve significantly advanced my knowledge of finance and have applied numerous concepts and skills learned in the program to my career already.

John Wierenga,

Corporate Development,

Amway Corporation Analyst

During this 12-month program, you will learn from faculty members who bring real-life executive experience and application-based scholarship to the class.

The Global MS in Finance program is engineered around the most advanced financial theories, quantitative models, and industry practices. Participants in the Global MSF program will utilize advanced methods to: analyze financial data; propose, structure, and execute financial and operational strategies; and benchmark results and modify financial plans accordingly.

Our student body is very diverse. Northwood has a large international presence both at our U.S. locations and abroad. Following graduation, our alumni are at ease in complex, multi-cultural business environments with a professional network of friends from around the world.

At Northwood, we know who our students are, and we care about them. Our personalized learning communities include not only students, but the entire faculty, administration, and staff, who care deeply about all the students who have made Northwood their university of choice. Learning takes place in more than just the classroom. With a multitude of activities from which to choose, students realize significant personal and professional growth which, after graduation, will set them apart as they launch their careers.

A Northwood University education has many distinctive components. Everything we do at Northwood University is designed to help graduates take their places as future leaders of a global, free-enterprise society.

CAMPUS LIFE

Be it academic-based organizations like the Entrepreneurship Society, Collegiate DECA or Business Professionals of America (BPA) to Greek Life to service-based organizations like Circle K, Rotaract, the Student Athletic Advisory Council or Student Government Association, Northwood University has ways for students to be engaged and involved on campus and in the local community. These experiences help students learn first-hand, how businesses and people connect through shared experiences.

PROFESSIONAL DEVELOPMENT

Northwood students graduate with a superior business education that gives them a foundation of understanding free markets, entrepreneurial endeavors, personal responsibility, and ethical behavior. And, NU students also graduate with the ability to effectively communicate their ideas, beliefs, and experiences in an effort to promote success in their own lives and in the lives of others. Through workshops and campus-life programming, students hone networking, interviewing and résumé writing skills putting them one more step ahead in a competitive job market.

EXPERIENTIAL LEARNING

One hallmark of the Northwood education is hands-on, experiential learning. Many of our academic programs enhance classroom learning with large-scale, active learning student-run projects. These events allow our students to apply what they learn in the classroom to real situations

ENTERPRISE/ENTREPRENEURIAL ORIENTATION

Many Northwood alumni earn their livelihoods in enterprises they own in whole or in part. While we offer a program in Entrepreneurship, our entire curriculum is focused on enterprise models and entrepreneurial achievements. Enterprise is a key tenet of our Mission, and we believe entrepreneurship is the essential element of our free market economy.

COMPETITIVE ADVANTAGE

While our student-athletes are competing on the athletic fields as part of the NCAA Division II Great Lakes Intercollegiate Athletic Conference (GLIAC); many of our students also compete in academic arenas. Our national champion Mock Trial team has bested teams from Harvard, Georgetown, and Stanford while our Competitive Speech team, American Marketing Association, BPA, DECA, and American Advertising Federation student chapters regularly place in regional and national competitions.

ABOUT NORTHWOOD

On March 23, 1959, two young men with an idea, a goal, and a pragmatic philosophy to encompass it all, broke away from their careers in a traditional college structure to create a new concept in education.

Their visionary idea became a reality when Dr. Arthur E. Turner and Dr. R. Gary Stauffer enrolled 100 students at Northwood Institute. They envisioned a new type of university – one where the teaching of management led the way. While the frontiers of space were revealing their mysteries, Stauffer and Turner understood all endeavors – technical, manufacturing, marketing, retail, every type of business – needed state-of-the-art, ethics-driven management.

Time has validated the success of what these two young educators called “The Northwood Idea” – incorporating the lessons of the American free-enterprise society into the college classroom.

The University grew and matured; Northwood went from being an Institute to an accredited University, the DeVos Graduate School of Management was created and then expanded; the Adult Degree Program and its program centers expanded to over 20 locations in eight states; international program centers were formed in Malaysia, People’s Republic of China, Sri Lanka, and Switzerland; and significant construction like the campus Student Life Centers added value to the Northwood students’ experience. New endeavors such as Aftermarket Studies, entertainment and sports management and fashion merchandising, along with a campus partnership in Montreux, Switzerland, demonstrate an enriched experience for all our students.

Northwood University educates managers and entrepreneurs – highly skilled and ethical leaders. With more than 65,000 alumni and a vibrant future ahead, The Northwood Idea is thriving.

ACCREDITATIONS, APPROVALS, AND MEMBERSHIPS

Northwood University believes it has a responsibility to its students and the industries and communities it serves to provide the highest standard of educational excellence possible. One measure of how well an educational institution meets this responsibility is in its accreditations and approvals by outside education associations and governmental interests. Because each Northwood location is served, at least partially, by different governmental agencies and academic accrediting bodies, and because all have been in existence for varying lengths of time, the accreditations and approvals may vary from one location to another.

ALL NORTHWOOD UNIVERSITY CAMPUSES/LOCATIONS HAVE THE FOLLOWING ACCREDITATIONS AND APPROVALS:

- Northwood University is accredited by the Higher Learning Commission (www.hlcommission.org). For more information, Please click here to learn more.

- Northwood University business degree programs have business specialty accreditation from the Accreditation Council for Business Schools and Programs (ACBSP), (www.acbsp.org).

- The United States Department of Homeland Security (DHS) certified school for nonimmigrant foreign students (Fvisa); Citizenship and Immigration Services (USCIS)/ Immigration and Customs Enforcement (ICE); and Student and Exchange Visitor Program (SEVP) as a higher education institution for international students.

- Respective state offices for Veterans Administration programs as a higher education institution for degree-seeking qualified veterans and dependents.

- The U.S. Bureau of Internal Revenue as a tax-exempt institution as provided for in Section 501 (c) (3) and other applicable parts of the Internal Revenue Code for higher education organizations.

NORTHWOOD UNIVERSITY MEMBERSHIPS ARE REPRESENTED IN SUCH EDUCATIONAL AND PROFESSIONAL ORGANIZATIONS AS:

- American Accounting Association

- American Advertising Federation

- American Association of Collegiate and Admissions Officers Registrars

- American Certified Fraud Examiners

- American College Health Association

- American College Personnel Association

- American Hotel and Lodging Association

- American Institute of Certified Public Accountants

- American Library Association

- American Management Association

- American Marketing Association

- American Marketing League Association

- American Payroll Association

- American Taxation Association

- Association for Communications Technology Professionals in Higher Education

- Association for Higher Education and Disability

- Association for Leadership Educators

- Association for the Tutoring Profession

- Association of College and Research Libraries

- Association of College and University Housing Officers International

- Association of College and University Telecommunications Administrators

- Association of Professional Researchers for Advancement

- Association of University Programs in Health Administration

- Association of Veterans Educators Certifying Officials

- Automotive Aftermarket Industry Association

- College and University Personnel Association for Human Resources

- Council for the Advancement of Experiential Learning

- Council for Higher Education Accreditation

- Council for Hotel and Restaurant and Institutional Education

- Data Processing Management Association

- Educause

- Family Enterprise Research Scholars

- Family Firm Institute

- Global Consortium of Entrepreneurship Centers

- Intercollegiate Press Association

- International Assembly for Collegiate Business Education

- International Council on Hotel, Restaurant & Institutional Education

- International Leadership Association

- Mathematical Association of America

- Motor and Equipment Manufacturing Association

- National Academic Advising Association

- National Advertising Federation

- National Association for Campus Activities

- National Association for College Admission Counseling

- National Association for Developmental Education

- National Association of College Admissions Counselors

- National Association of College Auxiliary Services

- National Association of College Stores (through its bookstore provider)

- National Association of College and University Business Officers

- National Association of Colleges and Employers

- National Association of Educational Buyers

- National Association of Independent Colleges and Universities

- National Association of Intercollegiate Athletics

- National Association of International Educators

- National Association of Graduate Admissions Professionals

- National Association of College and University Mail Services

- National Association of Student Financial Aid Administrators

- National Association of Student Personnel Administrators

- National Association of Veterans Programs Administrators

- National Automobile Dealers Association

- National Collegiate Athletic Association

- National Collegiate Honors Council

- National College Learning Center Association

- National Cooperative Education Association

- National Council of Teachers of English

- National Council of Teachers of Mathematics

- National Council of Women of the United States

- National Association of Educational Buyers

- National Association of Independent Colleges and Universities

- National Association of Intercollegiate Athletics

- National Association of International Educators

- National Home Fashions League

- National Restaurant Association

- Newspaper Association of America

- Organization of American Historians

- Photographers’ Association of America

- Society for College and University Planning

- Society for Human Resources

- Specialty Equipment Market Association

- The Fashion Group

- University Risk Management and Insurance Association